Following the release of the Republican tax plan, much is being made of the extent to which the proposal violates the long-held GOP and Tea Party (is there a difference?) concern about the growing federal deficit. Much like the failed attempts at ACA repeal and replace, this legislation is not based on long-held Republican or even conservative principles, but rather a desire to do anything, regardless of the consequences, for the sole sake of doing something. To remind you of what some of these principles are, I’ll let Republican representatives of the executive and legislative branches speak for themselves.

We want to get the federal government out of the business of subsidizing states./Treasury Secretary Steve Mnuchin, October 1, 2017

Is it fair that other states subsidize states that have high state taxes?/House Majority Leader Kevin McCarthy, September 29, 2017

If I live in a high tax state and you live in a low tax state, you actually pay more towards the federal government than I do. And that’s just not fair. It’s not right./White House Budget Director Mike Mulvaney, September 29, 2017

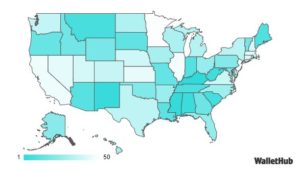

Makes sense except for one thing. It only looks at contributions to the federal treasury, not receipts. So the next logical step would be to see where the disparities exist and address them in a so-called comprehensive tax reform bill. Let’s do that. The following graphic (based on research by WalletHub) shows which states are most dependent on federal spending. In other words, they receive more than they contribute to the treasury in the form of federal taxes. The darker the color the more dependent the state.

It doesn’t take a rocket scientist to recognize the more dependent states generally have three things in common. One, they tend to have lower state and local tax rates: two, they have higher rates of poverty than the national average; and three, they voted for (drum roll) Donald J. Trump.

There certainly must be a logical reason for this. And there is. HIGH STATE AND LOCAL TAX STATES USE THEIR OWN REVENUES TO MEET THEIR NEEDS. In other words, they need less federal money because they “take personal responsibility” for themselves. Sound familiar? Maybe because the 1994 “Contract with America,” which led to the Republican revolution, was partially implemented via legislation titled (and I’m not making this up), “The Personal Responsibility Act.” It cut cash welfare and related programs.

Logic suggests Republicans would applaud examples of personal responsibility. Not only have they not acknowledged the value of state and local taxes on keeping federal spending lower than it might otherwise be, they have chosen to punish these states by eliminating the deduction for payment of state and local taxes.

Here is one more reason why this provision rises to the status of being the most hypocritical action in political history. It further violates every justification any Republican has ever used to argue against double taxation. Even within the proposed bill, the GOP screams that estate taxes are “double taxation.” Lower rates for capital gains and dividends are justified in the name of “double taxation.” LLCs and S-Corporations were created to avoid “double taxation.” Yet they have NO problem when it comes to ignoring the fact taxing state and local tax payments equals (let’s say it in unison), “DOUBLE TAXATION.”

I could go on and on. Doubling the standard deduction removes an incentive for lower and middle income family to make charitable donations. So much for encouraging people to take care of each other so the federal government doesn’t have to. In the Republican mantra, every life is precious until it includes a $4,000 personal exemption needed to underwrite major reductions in corporate taxes and fund the elimination of estate taxes and the alternative minimal tax (AMT).

NOTE: Remember, the leaked 2005 Trump IRS return in which he bragged about paying $31 million in income taxes. Without the AMT slated for elimination in the current bill, his tax bill would have been reduced by $26.7 million. Yet, on September 27, 2017, the liar-in-chief told reporters, “No, I don’t benefit. I don’t benefit. I’m doing the right thing and it’s not good for me, (here comes the famous Trump poker tell) BELIEVE ME.”

I am sure you saw the anecdote how House Speaker Paul Ryan kissed up to Trump by suggesting Trump name the bill “because he’s a branding genius.” Trump’s genius response, “The Cut, Cut, Cut Bill.” Well, I’m no marketing genius, but I do believe in truth in advertising. Therefore, may I suggest an alternate title (Are you listening, Kellyanne?). Let’s call it what it is, “The Cut the GOP Bullshit Bill.”

For what it’s worth.

Dr. ESP

How does one tell if a Republican is lying (intentionally or not)? Watch the mouth. If it opens, it’s a lie.

We have got to get the media to stop falling for the Liar and Thieves smoke and mirror show and report on the facts. They bring in talking heads that just yap about tweets rather than important information the people actually need to know. I wish more people read your blogs.