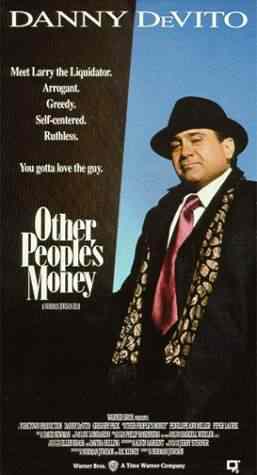

In the 1991 movie Other People’s Money, Lawrence “The Liquidator” Garfield, played by Danny DeVito, selects a struggling family-run business in a small Rhode Island town as his next target. I was reminded of this semi-successful film (Roger Ebert gave it 3.5 our of five stars) as I read a series of news articles this morning which claim Comrade Trump is “on pace to surpass eight years of Obama’s travel spending in one year.” (Source: CNN) Not to mention His Orangeness’ frequent trips to Mar-a-Lago/Winter White House/Southern White House have cost the residents of Palm Beach an estimated $1.7 million to date. Not to mention the New York Police Department estimates they spend $500,000/day on security for Melania and Baron Trump.

In the 1991 movie Other People’s Money, Lawrence “The Liquidator” Garfield, played by Danny DeVito, selects a struggling family-run business in a small Rhode Island town as his next target. I was reminded of this semi-successful film (Roger Ebert gave it 3.5 our of five stars) as I read a series of news articles this morning which claim Comrade Trump is “on pace to surpass eight years of Obama’s travel spending in one year.” (Source: CNN) Not to mention His Orangeness’ frequent trips to Mar-a-Lago/Winter White House/Southern White House have cost the residents of Palm Beach an estimated $1.7 million to date. Not to mention the New York Police Department estimates they spend $500,000/day on security for Melania and Baron Trump.

Trump’s willingness to appropriate “other people’s money” to sustain his extravagant lifestyle is only one way his modus operandi mirrors the plot of the film of the same name. While Garfield argues his offer is in the best interest of the community, the ensuing debate fractures both the owner’s family and the citizenry, many of whom work at and own equity in the business. Does this, Garfield’s speech to the local shareholders, sound familiar?

This company is dead. I didn’t kill it. Don’t blame me. It was dead when I got here. It’s too late for prayers. For even if the prayers were answered, and a miracle occurred, and the yen did this, and the dollar did that, and the infrastructure did the other thing, we would still be dead…Who cares? I’ll tell you. Me. I’m not your best friend. I’m your only friend.

All you have to do is substitute the word “America” for “this company” and you have Trump’s sales pitch in a nutshell.

What I will never understand is why the media think this is news. It is just one more chapter in the updated version of the The Art of the Deal. Trump has used his “charitable foundation,” which was funded with donations mostly from business associates who wanted to curry his favor, to cover his legal expenses and penalties.* He sold worthless stock in his casinos to suckers who ended up holding the bag when the ventures went bankrupt. And he is leveraged to the hilt in order to plaster his name on buildings he does not own.

But there is a hero in the movie. Andrew Jorgenson, played by Gregory Peck, who manages the New England Wire & Cable company, the town’s primary employer. Listen to Jorgenson’s rebuttal to Garfield’s justification of his takeover bid

The robber barons of old at least left something tangible in their wake- a coal mine, a railroad, banks. This man leaves nothing. He creates nothing. He builds nothing. He runs nothing. And in his wake lies nothing but a blizzard of paper to cover the pain…God save this country if that is truly the wave of the future. We will then have become a nation that makes nothing but hamburgers, creates nothing but lawyers, and sells nothing but tax shelters. And if we are at that point in this country, where we kill something because at the moment it’s worth more dead than alive, well, take a look around. Look at your neighbor. Look at your neighbor. You won’t kill him, will you? No. It’s called murder, and it’s illegal. Well, this, too, is murder, on a mass scale. Only on Wall Street, they call it maximizing shareholder value, and they call it legal. And they substitute dollar bills where a conscience should be.

Keep in mind this was 1991–before the Dotcom Bubble and before the sub-prime housing debacle. In hindsight, Jorgenson represents the closest thing we have to a modern-day Nostradamus. Too bad we didn’t listen to him.

*Kudos to Washington Post reporter David Farenholdt, who yesterday was awarded a Pulitzer Prize for his exposés on the misuse of Trump Foundation resources and his failure to follow-up on promised charitable donations.

For what it’s worth.

Dr. ESP

Yep. The death of our civilization can be directly traced to the “holder in due course” defense against lawsuits as specified in our “Uniform Commercial Code – existing, with insignificant change – in all 50 states. The devil is always in the details, most of which the general public has no knowledge. See the mortgage forclosure/banking crisis of 2008, focusing on “securitization” and “synthetic derivatives”.

https://en.wikipedia.org/wiki/Holder_in_due_course

Mortgage banking is based on the “house of cards” assumption of creating wealth without creating value.