This morning I decided it was time to address the “big lie.” No, not the one that has dominated the news since the November 2020 election. Not the one about elections or politics, but the one about federal versus state and local government. Or the related one about federal government versus the private sector or the average American household.

The timing for this entry is the coming barrage of Republican and conservative arguments why Americans cannot afford President Joe Biden’s “Build Back Better” infrastructure program. (Or as Carol Tucker-Foreman, director of the Consumer Federation of America’s Food Policy Institute suggested, “You can irradiate poop, but it’s still poop.”) Primary among them is the “big lie,” the federal government, when it comes to budgeting, should be held to the same standard as state and local governments, many of which are required by law to pass a balanced budget each year. Or, the even more populist argument, why should the federal government continue deficit spending when every family in America knows it should spend not more than it takes in.

There is room for legitimate debate whether all of the items on Biden’s wish list meet the definition of infrastructure, but the “re-woke” pay-as-you-go Tea Party Caucus would rather focus on the proposal’s impact on the federal deficit. Their argument being, the timetable for spending and revenues is a radical socialist plot which will bankrupt America and destroy our grandchildren’s future. Who could possibly believe allocating $2.2 trillion in improvements over eight years and then taking 15 years to recover the costs is a good idea? Ooh, ooh, I know the answer. EVERYBODY!!! State government. Local government. Business. And the overwhelming majority of American households.

Ready? It is called “capital budgeting.” Why does everyone except the federal government provide for it? Because it makes sense from an economic perspective, connecting the cost of major purchases or improvements to the timeframe required to recover the initial investment. Does anyone believe Delta Airlines writes a check for $100 million dollars every time it purchases a Boeing 757? It either finances or leases the equipment, making payments over the expected useful life of the aircraft. Is that not the same as deficit spending?

Or that a state or local government pays cash when it builds a new firehouse or upgrades water and sewer facilities? They issue municipal bonds which are paid off over the “shelf-life” of those improvements. Again, sounds an awful lot like deficit spending to me. These examples are based on the very same economic principles a bank employs when it lends you money for 30 years to purchase a house. Which, speaking of inter-generational obligations, becomes a liability for your heirs if not paid off before you die.

This is not a new idea, and if it has value, why has there been no movement to adopt it? Non-believers offer a rationale for their position that deserves an Oscar for most inconsistent argument of all time. On one hand, they claim the government needs to be run more like a business. So, when they see a one-time payment of $1.7 billion for 17 additional F35 fighter planes in Donald Trump’s FY2021 budget, you would think they might ask, as does the CFO of Delta Airlines, “Does it make sense to fully pay for them at the time of purchase rather than spread the cost over the life of the equipment?”

But wait. One of the primary reasons they are skeptics of federal capital budgeting is their belief (you guessed it) government does not operate like the business sector. It does not respond to the same stimuli and incentives as private enterprise. The underlying theory behind this position, held by both liberal and conservative economists, is the public sector is not subject to the same competitive forces in the marketplace when making decisions about capital expenditures. In 1998, the late Charles L. Schultz, director of the Office of Management and Budget under Jimmy Carter, wrote the following:

But wait. One of the primary reasons they are skeptics of federal capital budgeting is their belief (you guessed it) government does not operate like the business sector. It does not respond to the same stimuli and incentives as private enterprise. The underlying theory behind this position, held by both liberal and conservative economists, is the public sector is not subject to the same competitive forces in the marketplace when making decisions about capital expenditures. In 1998, the late Charles L. Schultz, director of the Office of Management and Budget under Jimmy Carter, wrote the following:

In the case of private investment, competitive forces and the search for profits automatically exert some discipline over the quality of projects selected by private investors.

Of course, this is the same Charles L. Schultz, who as a member of Carter’s Council of Economic Advisors, warned the U.S. was losing its competitive advantage in the global marketplace to countries like Japan. Some things do not change. This is the same hypocrisy voiced today by those who decry how Chinese investment to grow their economy creates an unlevel playing field, but will not even debate the Biden infrastructure proposal.

What if we approach this issue from the opposite perspective? If capital budgeting is such a bad idea, why not eliminate its use as an accepted accounting principle for everyone. Business would have to pay for major improvements in the same year the costs are incurred. School districts and local governments could not issue municipal bonds to cover school buildings or fire equipment. You and I would have no option other than to pay cash for a new car, boat or home. It does not require much imagination to realize what would happen. In economic terms, America would become a dystopian society even Hollywood is yet to imagine. If such a film were made, I suggest it be titled, “Mad Mitch: Beyond Blunder Dome.”

For what it’s worth.

Dr. ESP

Yes, even a general manager is paid less than the proposed $15/hour rate. [NOTE: Individual franchisees can diverge from the posted schedule.]

Yes, even a general manager is paid less than the proposed $15/hour rate. [NOTE: Individual franchisees can diverge from the posted schedule.] More than a half century later, the average age of Mustang buyers is 51 years old. As they became empty-nesters, many loyal Ford owners have stuck with the Dearborn-based company, trading in their Escapes and Explorers for the latest version of the “muscle car” including the 2020 Mustang Mach-E, an electric SUV crossover (pictured here). In other words, Ford used the Mustang brand to first attract the untapped youth market and later to recreate that experience for an older generation.

More than a half century later, the average age of Mustang buyers is 51 years old. As they became empty-nesters, many loyal Ford owners have stuck with the Dearborn-based company, trading in their Escapes and Explorers for the latest version of the “muscle car” including the 2020 Mustang Mach-E, an electric SUV crossover (pictured here). In other words, Ford used the Mustang brand to first attract the untapped youth market and later to recreate that experience for an older generation. I then anticipated an additional objection. Any new tax, regardless of its initial purpose, would be more federal revenue and would only lead to more spending, not debt reduction. So, I suggested any new tax must be dedicated to that specific purpose. Right on cue, he asked, “Wasn’t that supposed to be the case with Social Security. Yet Congress raids it constantly to cover the deficit?” Yes, that is why this new tax should be created by amending the constitution as was the case with the income tax. The 16th Amendment put restrictions on the imposition of a federal income tax.

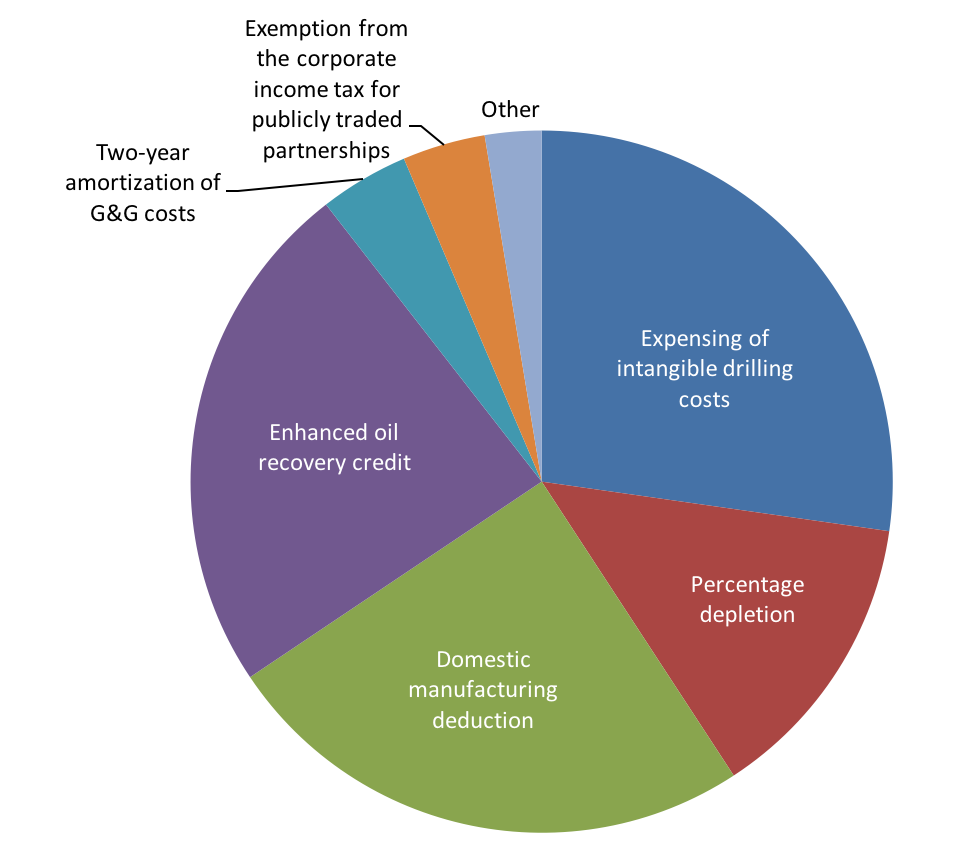

I then anticipated an additional objection. Any new tax, regardless of its initial purpose, would be more federal revenue and would only lead to more spending, not debt reduction. So, I suggested any new tax must be dedicated to that specific purpose. Right on cue, he asked, “Wasn’t that supposed to be the case with Social Security. Yet Congress raids it constantly to cover the deficit?” Yes, that is why this new tax should be created by amending the constitution as was the case with the income tax. The 16th Amendment put restrictions on the imposition of a federal income tax. In contrast, the FY2020 federal budget included $16 billion for Temporary Assistance for Needy Families (TANF). $66 billion for Supplemental Nutritional Assistance Program (SNAP) and $60 billion for HUD Housing Assistance. Compare that to the estimated $649 billion in direct and indirect U.S. subsidies to the fossil fuel industry in 2015. (Source: International Monetary Fund).

In contrast, the FY2020 federal budget included $16 billion for Temporary Assistance for Needy Families (TANF). $66 billion for Supplemental Nutritional Assistance Program (SNAP) and $60 billion for HUD Housing Assistance. Compare that to the estimated $649 billion in direct and indirect U.S. subsidies to the fossil fuel industry in 2015. (Source: International Monetary Fund). The above quote was made in reference to understanding the impact of charitable investments (i.e. grants, research and programs) by the Kauffman Center for Entrepreneurial Leadership for which Slaughter served as its first president. I was reminded of this warning as I watched the on-going congressional deadlock over the size of COVID-19 stimulus checks. My first epiphany was I had often paid attention to only half of what my colleague and friend was trying to tell us. Being a trained empirical social scientist, my focus had been on data collection and analytical methodology. But that was just one side of the equation. Too often I assumed I already knew what was important. But in this case I was not so sure. In other words, one needs not only to establish the method by which something is measured, but the why. Why would anyone want to expend time and effort measuring something in the first place?

The above quote was made in reference to understanding the impact of charitable investments (i.e. grants, research and programs) by the Kauffman Center for Entrepreneurial Leadership for which Slaughter served as its first president. I was reminded of this warning as I watched the on-going congressional deadlock over the size of COVID-19 stimulus checks. My first epiphany was I had often paid attention to only half of what my colleague and friend was trying to tell us. Being a trained empirical social scientist, my focus had been on data collection and analytical methodology. But that was just one side of the equation. Too often I assumed I already knew what was important. But in this case I was not so sure. In other words, one needs not only to establish the method by which something is measured, but the why. Why would anyone want to expend time and effort measuring something in the first place?