The question of the day: “Why is it so hard to come up with solutions to the nation’s most pressing problems?” Hopefully, the following example sheds some light on this often voiced critique of government as each option requires balancing opposing objectives.

A recent conversation with a long time friend and colleague focused on the pending COVID-19 relief package. While we agreed those who had suffered the most economically during the pandemic need additional help, he asked the question most fiscal conservatives have ignored the past four years, “Who is going to pay for it?” He then challenged me to come up with a way to pay down the national debt.

Within 24 hours I gave him one option based on the following facts and assumptions.

- The national debt is approaching $28 trillion. With the addition of a $1.9 trillion relief package it will top $30 trillion in the coming fiscal year even with an anticipated rebound in GDP and employment.

- Labor is already heavily taxed when you take into account income tax, social security and Medicare.

- Non-labor income has had a relatively free ride. Dividends and capital gains are taxed at a lower rate than labor-based income. Hedge fund managers (you know, those people who bet AGAINST the U.S. economy) can defer income and have it treated as capital gains rather than management fees.

- Increasing government revenue is about more than tax rates. It also depends on the base, i.e. the goods and services to which the rate is applied. States and localities, most of which are required to balance their annual budgets, have added once tax-free commodities (e.g. downloaded software) to the list of taxed items to meet their constitutional requirement to match revenues and expenditures.

These facts and assumptions set the direction in which I sought a solution to the debt. Was there a currently un-taxed good or service that could generate enough revenue to pay off the national debt? If so, could it be taxed and how? And finally, would such revenue source infringe on state and local receipts?

The answer to the first question was easy. How is buying stock different from purchasing a computer, car or clothing? And stock transactions are not taxed by state or local governments. The logical conclusion? Impose a sales tax on the value of a stock purchase. But would it generate enough income to eliminate the debt. To determine this, I looked at the data about stock transactions on one day (December 31, 2020).

- The value of all stock sales (including all U.S. exchanges) totaled $411.2 billion. I chose New Years Eve because sales volume is historically lower than an average day making any annual projection more conservative than might be expected.

- A 2.5 percent national sales tax would generate $10.3 billion on that one day.

- The markets are open 253 days annually.

- The annual revenue from the sales tax would be $2.6 trillion.

- At this rate, the current debt of $28 trillion could be paid off in less than 11 years.

If, however, you thought a 2.5 percent rate was too high, lower it to 1.0 percent. Annual receipts would fall to $1.04 trillion, eliminating the current debt in just under 27 years.

I then applied it to my own stock transition history for calendar year 2020. I had purchased stock valued at $30,053. At 2.5 percent my contribution to debt relief would be $751 for 2020. That seemed to make sense as a fair share for someone with our net worth.

My friend, who lives on the other side of the tracks (the good side), suggested his 2020 contribution would have been $300,000, to which he added the word, ‘Gulp!” But, if you do the math, that meant he purchased $12 million in stock value last year. To which I replied I doubted anyone who could spend $12 million on stock in a single year would miss a meal because of the new tax. And then asked, “Would you prefer we treat dividends and capital gains as regular income subject to your marginal rate?” He did not even reply to that inquiry.

I then anticipated an additional objection. Any new tax, regardless of its initial purpose, would be more federal revenue and would only lead to more spending, not debt reduction. So, I suggested any new tax must be dedicated to that specific purpose. Right on cue, he asked, “Wasn’t that supposed to be the case with Social Security. Yet Congress raids it constantly to cover the deficit?” Yes, that is why this new tax should be created by amending the constitution as was the case with the income tax. The 16th Amendment put restrictions on the imposition of a federal income tax.

I then anticipated an additional objection. Any new tax, regardless of its initial purpose, would be more federal revenue and would only lead to more spending, not debt reduction. So, I suggested any new tax must be dedicated to that specific purpose. Right on cue, he asked, “Wasn’t that supposed to be the case with Social Security. Yet Congress raids it constantly to cover the deficit?” Yes, that is why this new tax should be created by amending the constitution as was the case with the income tax. The 16th Amendment put restrictions on the imposition of a federal income tax.

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

Those restrictions have been upheld time and time again by the courts. Therefore, the “power to lay and collect taxes” on the value of stock purchases for the sole of purpose of paying down the national debt could have the same judicial weight if violated by any future Congress.

After he shared my idea with several wealth managers, my colleague said their message was crystal clear. Wall Street will never accept a tax. I needed to focus on fees. He recommended a $1.00 fee on transactions over $100. Unfortunately this option had two drawbacks. First, even if the $1.00 fee was applied to all transactions, the total daily revenue would be approximately two billion dollars, one fifth of that generated by the 2.5 percent sales tax. Therefore, eliminating the current debt would take 55 as opposed to 11 years. Second, a fee per transaction is highly regressive. If I buy one share of IBM at $128, the fee would be equal to 0.7 percent of my purchase. If my colleague buys one share of Berkshire Hathaway Class A stock for $365,000, his fee is 0.00027 percent of his transaction.

He came back with a suggestion the fee apply only to transactions over $1,000. Okay, that makes it a little less regressive. However, the average value of all transaction is approximately $117.60 (total dollar volume divided by block volume). In other words, the cost of making any fee less regressive is a corresponding decline in the revenue needed to erase the debt.

Which brings me to the title of this post. After raising the more regressive nature of the fee over a percentage tax on transaction value, my friend responds, “Life isn’t fair.” To which I reply, “You’re right about life not being fair. But it’s fairer if you are rich and have lobbyists.” Let me explain.

We hear a lot from fiscal conservatives about the cost of the social safety net. Of course there are abuses, but the general principle is the “net” is designed as a hand up, not a hand-out, especially when Americans fall on hard times. What we never hear about is the “corporate safety net.” Consider the following occasions on which corporate America turned to the government for assistance which responded with the associated federal outlays.

- 1980s savings and loan crisis ($132.1 billion)

- 2008 subprime crisis ($700 billion)

- 2018 tax act yearly impact on corporate tax receipts ($116 billion/Source: Forbes)

- 2019 farm crisis due to Trump tariffs ($41 billion)

- 2020 pandemic relief to major industries in the CARES Act ($208 billion)

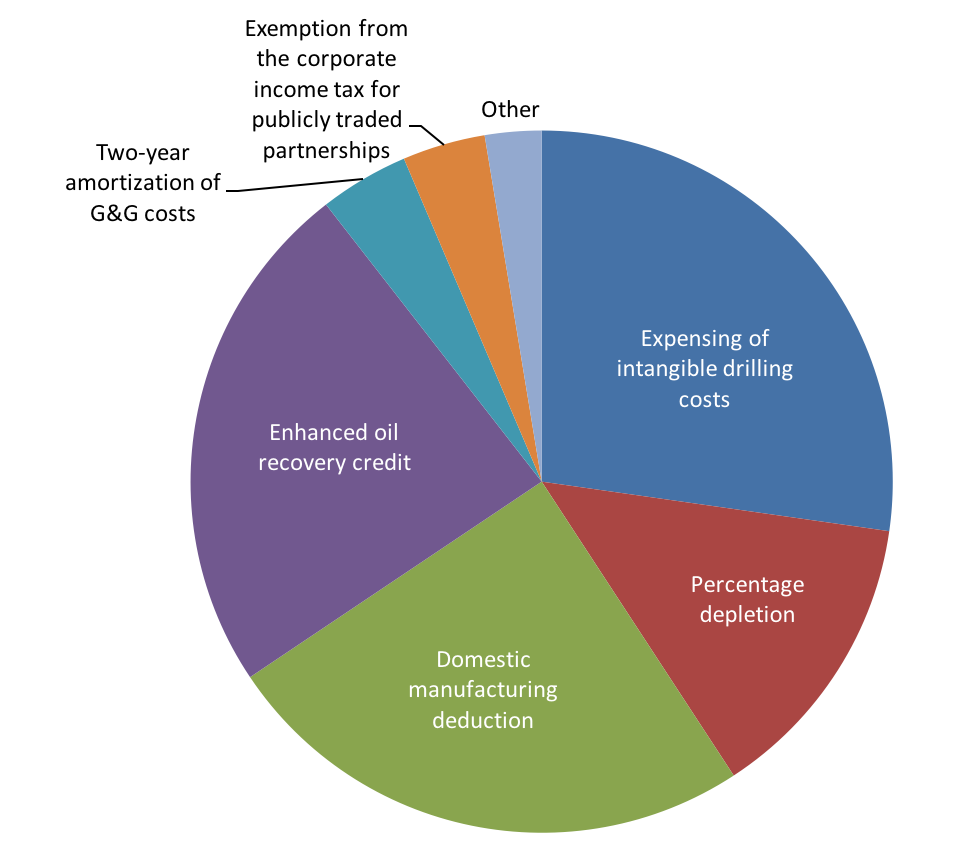

In contrast, the FY2020 federal budget included $16 billion for Temporary Assistance for Needy Families (TANF). $66 billion for Supplemental Nutritional Assistance Program (SNAP) and $60 billion for HUD Housing Assistance. Compare that to the estimated $649 billion in direct and indirect U.S. subsidies to the fossil fuel industry in 2015. (Source: International Monetary Fund).

In contrast, the FY2020 federal budget included $16 billion for Temporary Assistance for Needy Families (TANF). $66 billion for Supplemental Nutritional Assistance Program (SNAP) and $60 billion for HUD Housing Assistance. Compare that to the estimated $649 billion in direct and indirect U.S. subsidies to the fossil fuel industry in 2015. (Source: International Monetary Fund).

So, the next time you hear a politician rail about entitlements and the welfare state being responsible for the national debt, those living in poverty are not the only beneficiaries. Or when you hear Republicans accuse Democrats of wanting to give everything away for free, think about who else is currently on a free or heavily subsidized ride in America.

Deficit hawks who constantly preach about the critical need to bring down the national debt are no better than those they claim are living off the American taxpayer. They want to balance the budget and eliminate the national debt. But please, please do not ask them to pay to do it. That is what makes them “WealthFare Queens.”

For what it’s worth.

Dr. ESP

After a careful read and re-read I am persuaded to endorse your argument with two caveats at 2.5%. Make the tax, tax deductible and pass the needed amendment first.

I would hope that the current office holders could get the ball rolling?

Both requests are reasonable.

Makes sense, at least a good start.

That fact assures that it will never happen.