The Invisible Back of the Hand

Invisible hand, metaphor, introduced by the 18th-century Scottish philosopher and economist Adam Smith, that characterizes the mechanisms through which beneficial social and economic outcomes may arise from the accumulated self-interested actions of individuals, none of whom intends to bring about such outcomes.

~F. Eugene Heath/Encyclopedia Britannica

Yesterday, a verbal sparring match between Senator Elizabeth Warren (D-MA) and JP Morgan CEO Jamie Dimon dominated the business news cycle. At the center of the exchange (excerpted below) was Warren’s contention that JP Morgan’s excessive overdraft fees took advantage of customers at a time of high financial distress among their clientele.

Yesterday, a verbal sparring match between Senator Elizabeth Warren (D-MA) and JP Morgan CEO Jamie Dimon dominated the business news cycle. At the center of the exchange (excerpted below) was Warren’s contention that JP Morgan’s excessive overdraft fees took advantage of customers at a time of high financial distress among their clientele.

Warren: So Mr. Dimon, how much did JP Morgan collect in overdraft fees from their consumers in 2020?

Dimon: Well, I think your numbers are totally inaccurate, but we’ll have to sit down privately and go through that.

Warren: These are public numbers. Can you just answer my question? How much did JP Morgan collect?

Dimon: I don’t know the number in front of me. Upon request we waived the fees.

Warren: Well, I actually have it in front of me. $1.463 billion.

Sadly, this was the least of the moral lapses exhibited by large banks in 2020. To counter the risk associated with loans to struggling business, the Coronavirus Aid, Relief and Economic Security Act (CARES), signed into law on March 31, 2020, included $349 billion for banks to lend to their small business customers. To further support riskier lending, the act included certain regulatory relief.

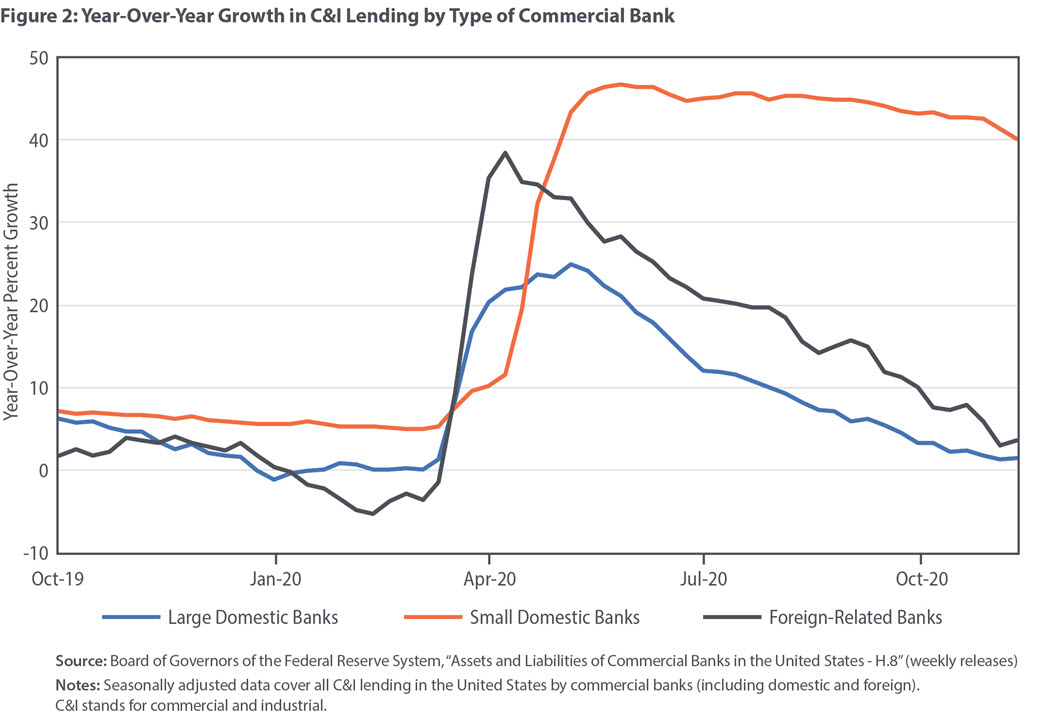

There was one caveat. Banks were prohibited from using the newly available funds for stock buybacks. The following chart displays the difference in actual lending during 2020 by independently owned community banks (orange line) and large national banks (blue line). Note that smaller banks used these resources to increase their year-to-year loan generation by more than 40 percent for an extended period of time. In contrast, corporate banking giants showed an initial 25 percent increase which quickly fell to pre-COVID levels. Why? Anticipation the stock buyback exclusion would eventually be lifted, which it was in December 2020. And right on cue, these corporate entities used their cash reserves for buybacks, enriching stockholders and corporate officers.

In response Warren has proposed the The Accountability Capitalism Act, best characterized as a return to classic Adam Smith economics based on his belief giant corporations should look out for American interests. It is not socialism or Marxism. It does not involve nationalization of ANY industry. It relies on the “benefit corporation” model, which according to Warren, “gives businesses fiduciary responsibilities beyond their shareholders.” In other words, Senator Warren is suggesting America is better served by an open invisible hand than a slap in the face with the back side of one.

From the People Who Brought You Trickle Down Economics

Where could the practices of exploiting a pandemic by imposing outrageous overdraft fees or using public assistance for stock buybacks possibly have originated? That is a tough question to pin down. What we do know is the timeline. In 1981, the Business Roundtable, comprised of CEOs of the nation’s largest and most profitable institutions recognized their broader social and community obligations, issuing the following statement.

Corporations have a responsibility, first of all, to make available to the public quality goods and services at fair prices, thereby earning a profit that attracts investment to continue and enhance the enterprise, provide jobs, and build the economy.

However, by 1997, their tune had morphed into a different prime directive orchestrated by conservative economists such as Milton Friedman, who espoused the theory corporate directors had ONLY one obligation; to maximize shareholder returns. What was the impact of the Roundtable’s adoption of this “us first” approach, “The principal objective of a business enterprise is to generate economic returns to its owners?” In an August 2018 Wall Street Journal op-ed, Senator Warren provides the following clues.

- In the 1980s, large U.S. companies returned less than half their earnings to shareholders. Between 2007 and 2016, those same companies “dedicated 93 percent of their earnings to stockholders.”

- Pre-1991, wages and productivity grew at about the same rate. Over the past three decades, wages have stagnated while productivity continues to grow.

- Shareholder maximization translated into an explosion in CEO compensation. In the 1980s, executive compensation rarely included equity in the company. “Today, it accounts for 62 percent of their pay.”

- In 1980, the average CEO compensation was 42 times that of an average worker. Today that ratio is 361:1.

So, to all of her critics who ask, “When and why did Elizabeth Warren abandon capitalism,” the better question might be, “When and why did the modern day barons of industry abandon Adam Smith’s vision of capitalism?”

How Dare Workers Act in Their Own Self-Interests

So corporate America loves to justify their business model as the consequence of a free market. However, when these same forces produce an outcome inconsistent with the desired goals of conservative economists, they cry foul. The best example is right wing media’s uproar over extended unemployment benefits.

Instead of accusing the labor force of laziness by choosing unemployment over a job, consider the following. If you had a choice of staying home for $15/hour without the cost of transportation and day care versus $7.25/hour further eroded by associated expenses, what would you do? Imagine the following policy statement from a hypothetical Work Force Roundtable. “The principle objective of heads of households is to maximize return to one’s family.”

Where are the proponents of free market, invisible hand economics now? Is this not an opportunity to test how elastic or inelastic the price of labor is? If higher wages or better benefits bring workers back into the labor force, there is your answer. Workers are merely stating the obvious. Our time and well-being has a value. And there is a price point where your demand for my value intersects with my willingness to supply it.

In other words, when the laws of supply and demand, elasticity, et. al. explain economic and social inequality and injustice, corporate America and conservative economists turn a blind eye, they claim the system is out of balance, that the “LEFT hand” is overly dominant. But when those economic principles justify their greed, these same financial experts argue the “RIGHT hand” should not only be dominant, it should be adorned with gold plated brass knuckles.

Corporate Accountability, Not Marxist

When progressives like Elizabeth Warren raise these issues, they are not, as GOP talking points suggest, promoting Marxism or communism. They are only preaching a reverse variation of St. Augustine’s declaration cum dilectione hominum et odio vitiorum (With love of mankind and hatred of sins), which evolved into the present day adage “Love the sinner; hate the sin.” In pursuit of economic and social justice, they are merely stating, “Love Adam Smith’s theory of capitalism, but abhor false prophets who misuse it.”

For what it’s worth.

Dr. ESP

Elizabeth is correct, as far as it now is. But beware of blockchain oriented crypto and “digital currencies”. Lots of bad actors – but China, also, is into it. https://theconversation.com/chinas-digital-currency-could-be-the-future-of-money-but-does-it-threaten-global-stability-160560