Last week, I mentioned how current events have triggered reminders of past life experiences. This morning was one more of those occasions. The prompt was a CNN report under the heading, “Tiger Woods won’t face charges after sheriff says car crash was an accident.”

The year was 1993. I was lead staff for a National Governors Association project to establish uniform state policies for the regulation of the hazardous materials (HM) trucking industry. The first step involved formation of a working group consisting of state and local officials, environmental interests and the industry. In preparation for the first meeting I met with staff from the National Highway Transportation Safety Agency (NHTSA) to confirm what I believed to be the primary goal of the project: reconcile the myriad difference in HM regulations among the contiguous 48 states while still ensuring safe movement of some pretty nasty stuff within the legal definition of HM ranging from large quantities of nail polish to radioactive waste.

The project was a compromise with the industry which pushed for federal preemption of state authority. During congressional hearings for what became the Hazardous Materials Transportation Uniform Safety Act of 1990 (HMTUSA), states made the case they already had the infrastructure in place to regulate the industry. To shift responsibility to Washington, D.C. would require a significant increase in federal resources and staffing, something the George H. W. Bush Transportation Department was not ready to support.

At the NHTSA briefing, I asserted the states’ primary objective was prevention of accidents which resulted in HM spills which threatened both human safety and the environment. I was immediately stopped and told (paraphrasing}, “There are no such things as accidents. DOT uses the term ‘incident.’ There is either equipment failure or operator error.” For example, metal fatigue results in a broken axle. A driver falls asleep after violating mandatory rest stops. The shipper inadequately secures the cargo. Even incidents related to so-called “acts of God” are avoidable if the proper preventive measures are employed.

Too bad Los Angeles County Sheriff Alex Villanueva had not been in attendance at that briefing. On a Facebook Live chat about Tiger Woods, Villanueva said:

We don’t contemplate any charges whatsoever in this crash. This remains an accident. An accident is not a crime. They do happen, unfortunately.

Accidents do not just happen. Villanueva reminds me an of old Joan Rivers joke about the business executive calling a tryst with his secretary an accidental affair. His wife responds, “Did you slip on a banana peel and fall into her vagina?”

None of us knows exactly what happened, but if you look at the following range of possibilities, it is hard to call what occurred at 7:12 am this past Tuesday an accident.

- The steering rod breaks or other equipment on the Genesis GV80 Woods was driving fails. Not a great advertisement for a car with a $48,900 base price and title sponsor of last week’s PGA tournament for which Woods was the host professional. Though the price seems worth it based on the survivability factor in such a horrific crash and rollover.

- Woods was late for a photo session at Riviera County Club and may have been exceeding the speed limit to make up time.

- Two days earlier Woods had talked with CBS’ Jim Nance about his discomfort from December back surgery. One would think he might consider a driver as the normal one hour drive from his hotel to the Club would test his tolerance level to be strapped in, relatively immobile for that length of time.

- There could have been an object in the road (e.g. animal or pothole) in which case the driver would be expected to slow down to avoid it.

- Though the police at the scene claims he did not seem to be impaired, his condition and the need to get him to the Harbor-UCLA trauma center ASAP meant that normal on-site breath or dexterity tests were not employed (now known as the Bruce Springsteen defense).

- Perhaps conditions demanded vehicles proceed at less than the posted speed limit.

- Or Woods simply did not appreciate how fast the car was going due to the exceptionally smooth ride, quiet interior and the 375 horsepower engine under the hood.

Surely, no one believes Woods intended for this to happen. But it is just one more example of the difference between intent and accountability. I will leave it to the judicial system to decide if any laws were violated. Though there is a touch of irony. A major objection to the use of excessive force by police in several noted cases is when the arresting officer exceeds his/her authority becoming the judge and jury. In this case, Villanueva did much the same thing, except, playing prosecutor, judge and jury, he singlehandedly acquitted the suspect.

Maybe the Stephen Sondheim musical “Into the Woods” is actually a metaphor for encounters with law enforcement. If you are a famous athlete involved in a serious car crash which could endanger life and property or rock star arrested for DUI, the relevant song is “No One is Alone” from Act II. The police and courts have your back. But if you are an average Joe or Jane with a burned out taillight or you are jaywalking, you have a different take on the encounter. “Agony!”

For what it’s worth.

Dr. ESP

More than a half century later, the average age of Mustang buyers is 51 years old. As they became empty-nesters, many loyal Ford owners have stuck with the Dearborn-based company, trading in their Escapes and Explorers for the latest version of the “muscle car” including the 2020 Mustang Mach-E, an electric SUV crossover (pictured here). In other words, Ford used the Mustang brand to first attract the untapped youth market and later to recreate that experience for an older generation.

More than a half century later, the average age of Mustang buyers is 51 years old. As they became empty-nesters, many loyal Ford owners have stuck with the Dearborn-based company, trading in their Escapes and Explorers for the latest version of the “muscle car” including the 2020 Mustang Mach-E, an electric SUV crossover (pictured here). In other words, Ford used the Mustang brand to first attract the untapped youth market and later to recreate that experience for an older generation. Some are minor moments in time with multiple degrees of separation, insignificant in the broader scheme of things. Yesterday’s Washington Post reported two former first daughters, Chelsea Clinton and Jenna Bush, joined a group that purchased the WNBA Washington Spirit. Current and former residents of Austin cannot see Jenna’s or her twin sister Barbara’s name and not think about the 2001 incident when they, then students at the University of Texas, used false IDs to order drinks at the city’s go-to Tex-Mex restaurant Chuy’s, an establishment we patronized on many occasions. I am sure they were not the first nor the last Longhorns guilty of underage drinking at this cantina known for its paintings on velvet canvas or the wooden pterodactyls hanging from the ceiling. Their particular crime, of course, was being very recognizable presidential offspring.

Some are minor moments in time with multiple degrees of separation, insignificant in the broader scheme of things. Yesterday’s Washington Post reported two former first daughters, Chelsea Clinton and Jenna Bush, joined a group that purchased the WNBA Washington Spirit. Current and former residents of Austin cannot see Jenna’s or her twin sister Barbara’s name and not think about the 2001 incident when they, then students at the University of Texas, used false IDs to order drinks at the city’s go-to Tex-Mex restaurant Chuy’s, an establishment we patronized on many occasions. I am sure they were not the first nor the last Longhorns guilty of underage drinking at this cantina known for its paintings on velvet canvas or the wooden pterodactyls hanging from the ceiling. Their particular crime, of course, was being very recognizable presidential offspring. On Christmas Day, several state officials, myself included, were asked to be in the governor’s office at 8:00 a.m. the next morning. As is the case again this week, the entire produce industry in south Texas was devastated, and the unemployment rate along the border was projected to reach 60 percent in the most agricultural counties. Among the resources within my jurisdiction was a $41 million allocation under the federal Community Development Block Grant Program (CDBG). As I tell this story, keep in mind my only prior interaction with Governor White had been a brief introduction during my first visit to the capitol as a state employee. He more likely associated me with the letters he received, including one from the city manger of Three Rivers, suggesting “Sam Houston was spinning in his grave” for White’s having hired “a gringo from Washington, D.C. for a job that should have gone to a native Texan.”

On Christmas Day, several state officials, myself included, were asked to be in the governor’s office at 8:00 a.m. the next morning. As is the case again this week, the entire produce industry in south Texas was devastated, and the unemployment rate along the border was projected to reach 60 percent in the most agricultural counties. Among the resources within my jurisdiction was a $41 million allocation under the federal Community Development Block Grant Program (CDBG). As I tell this story, keep in mind my only prior interaction with Governor White had been a brief introduction during my first visit to the capitol as a state employee. He more likely associated me with the letters he received, including one from the city manger of Three Rivers, suggesting “Sam Houston was spinning in his grave” for White’s having hired “a gringo from Washington, D.C. for a job that should have gone to a native Texan.”

I then anticipated an additional objection. Any new tax, regardless of its initial purpose, would be more federal revenue and would only lead to more spending, not debt reduction. So, I suggested any new tax must be dedicated to that specific purpose. Right on cue, he asked, “Wasn’t that supposed to be the case with Social Security. Yet Congress raids it constantly to cover the deficit?” Yes, that is why this new tax should be created by amending the constitution as was the case with the income tax. The 16th Amendment put restrictions on the imposition of a federal income tax.

I then anticipated an additional objection. Any new tax, regardless of its initial purpose, would be more federal revenue and would only lead to more spending, not debt reduction. So, I suggested any new tax must be dedicated to that specific purpose. Right on cue, he asked, “Wasn’t that supposed to be the case with Social Security. Yet Congress raids it constantly to cover the deficit?” Yes, that is why this new tax should be created by amending the constitution as was the case with the income tax. The 16th Amendment put restrictions on the imposition of a federal income tax. In contrast, the FY2020 federal budget included $16 billion for Temporary Assistance for Needy Families (TANF). $66 billion for Supplemental Nutritional Assistance Program (SNAP) and $60 billion for HUD Housing Assistance. Compare that to the estimated $649 billion in direct and indirect U.S. subsidies to the fossil fuel industry in 2015. (Source: International Monetary Fund).

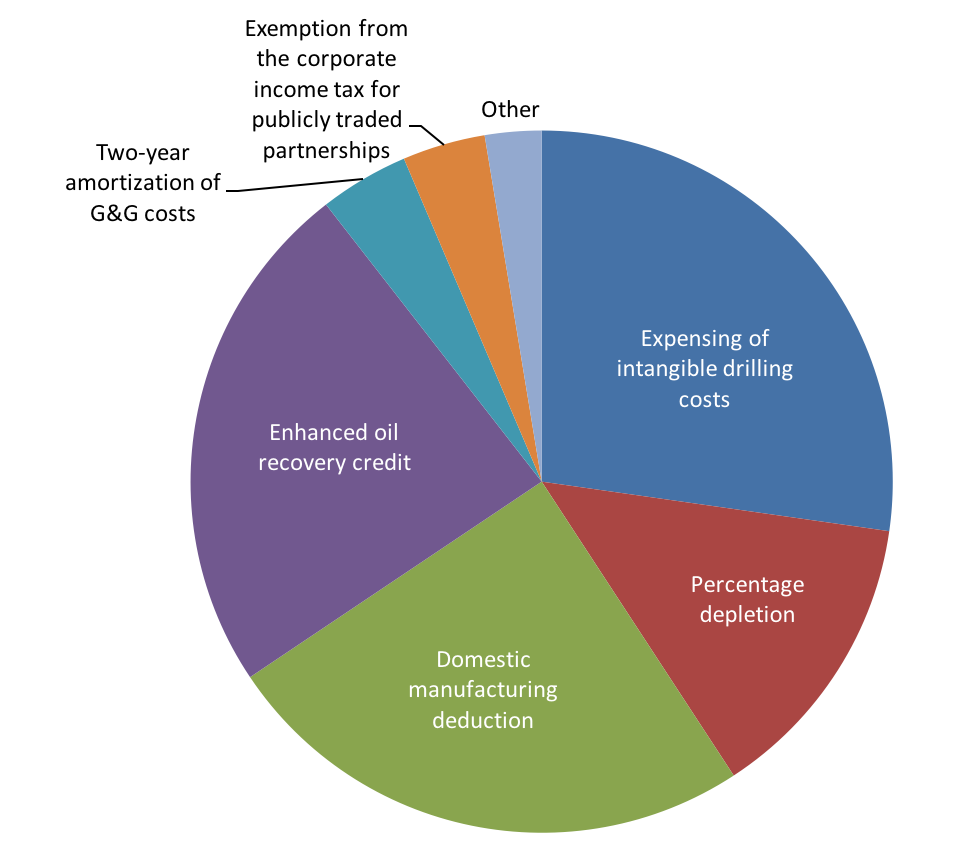

In contrast, the FY2020 federal budget included $16 billion for Temporary Assistance for Needy Families (TANF). $66 billion for Supplemental Nutritional Assistance Program (SNAP) and $60 billion for HUD Housing Assistance. Compare that to the estimated $649 billion in direct and indirect U.S. subsidies to the fossil fuel industry in 2015. (Source: International Monetary Fund).