Since its inclusion in the House of Representatives version of the $1.9 trillion American Rescue Plan and parliamentary exclusion from the Senate version, there has been a lot of discussion about raising the minimum wage to $15/hour. Unfortunately, political debate over this issue has drowned out enlightening economic considerations. So let me take a minute to talk about what the new standard represents.

At $15/hour a worker would have a gross annual salary of $31,200. This is still less than half or the 2019 average annual household income in the U.S. of $68,703. And for the record, it is 17.9 percent of the $174,000 salary of a U.S. Senator or Representative each of whom has received three salary increases since 2006, the last time Congress raised the federal minimum wage.

But salary comparisons are only half the story. After employee contributions to Social Security and Medicare ($2,387), plus income tax on taxable income ($1,920), net take home pay is $26,893 or $2,241/month. Of that amount, the majority ($2090) goes toward the following three items. NOTE: West Virginia has the lowest monthly housing costs while New York and California are over $1250/month.

Average Monthly Rent/$725 (WV)

Average Monthly Household Food Budget/$552

Average Monthly Transportation Cost per Individual/$813

The situation does not improve dramatically for a two-income household which may now include daycare at an average of $972/month and additional transportation costs. And neither scenario includes other necessities such as clothing, education costs, etc. A $15/hour minimum wage is no walk in the park. Anything less is a jungle.

But, as usual, that is not what I came here to talk about. Understanding why we do not have a higher minimum wage is as important as whether we need to mandate one. There are several but the one that gets the most attention is income inequality. Yes, politicians and analysts will point to the growing disparity between management and worker salaries and benefits. And they are correct. In 1965, the CEO-to-average worker compensation ratio (salary and benefits) was 21:1. In 2019, that same statistic is 320:1.

However, no one seems willing to tackle an underlying variable which may be the most significant deterrent to a living wage. To address what I believe is this bigger and less obvious reason, I will compare two very familiar brands: Amazon and McDonalds. In January 2018, Amazon announced it would begin paying all full-time, part-time and seasonal workers a minimum $15/hour. [NOTE: Pressure from Senator Bernie Sanders and others contributed to this policy change.] How could they do this? Did founder Jeff Bezos contribute a major portion of his $182 billion net worth to the salary pool? Not that I am aware of.

Instead, Amazon was able to raise its minimum wage without tapping Bezos’ fortune because it operates on a value proposition that generates enough revenue to compensate its workers at the new standard and continue to make shareholders (not to mention Bezos or his ex-wife) happy. Think about it. Amazon customers believe they get enough value from this service, not only do they patronize the company. One hundred twelve million households pay an annual fee (Amazon Prime) to have access to a higher level of service.

In contrast, McDonalds provides the following schedule of average salaries by position.

Team Trainer: $9.28/hour

Cook: $9.36/hour

Fast Food Attendant: $9.79/hour

Shift Manager: $12.01

General Manager: $14.67

Yes, even a general manager is paid less than the proposed $15/hour rate. [NOTE: Individual franchisees can diverge from the posted schedule.]

Yes, even a general manager is paid less than the proposed $15/hour rate. [NOTE: Individual franchisees can diverge from the posted schedule.]

One would expect McDonalds’ management to be a major opponent of a federally mandated $15/hour minimum wage. However, during a January 2021 earnings call to investors, CEO Chris Kempcziski reported the company is “doing just fine” in those states in which wage minimums exceed the federal standard. A four-year analysis commissioned by McDonalds management found there had been no closures, job losses or increased automation directly related to increased salaries.

The higher labor costs were absorbed by an increase in the price of the franchise’s signature Big Mac. By how much? Economists participating in the four-year study estimate “a 10 percent increase in the minimum wage led to a 1.4 percent increase in the price of a Big Mac.” Equally important, “customers did not eat significantly fewer Big Macs as a result of the price hike.” Imagine that. McDonalds could raise each employees salary by 50 percent by increasing the cost of Big Macs by seven percent from an average of $3.50 to $3.75. If the price hike was spread across multiple menu items, that increase would be even less noticeable.

The source of its value proposition is not important. In McDonalds’ case I doubt if it is the food. Maybe it is simply brand recognition. Consistency of product regardless of overall quality. Or maybe it is just keeping the kids happy for an hour. Bottom line? Their own analysts admit there is something about the company which makes their products inelastic enough to increase customer pricing to the point where a $15/hour minimum wage will not make the Golden Arches collapse.

My point? We need to stop asking, “Are some employees worth $15 an hour?” Maybe it is time to approach the question from a different perspective. Should companies which provide goods and services be expected to create enough value their customers are willing to bear the price required to pay the company’s workforce a decent wage? And, if they do not create that value, should they step aside to make room for other companies that can?

In other words, a fast food restaurant that survives if, and only if, to attract customers, it offers a sandwich, fries and drink at a price so low it cannot pay its workers a living wage, maybe they should advertise it as a “NO-VALUE MEAL.”

For what it’s worth.

Dr. ESP

More than a half century later, the average age of Mustang buyers is 51 years old. As they became empty-nesters, many loyal Ford owners have stuck with the Dearborn-based company, trading in their Escapes and Explorers for the latest version of the “muscle car” including the 2020 Mustang Mach-E, an electric SUV crossover (pictured here). In other words, Ford used the Mustang brand to first attract the untapped youth market and later to recreate that experience for an older generation.

More than a half century later, the average age of Mustang buyers is 51 years old. As they became empty-nesters, many loyal Ford owners have stuck with the Dearborn-based company, trading in their Escapes and Explorers for the latest version of the “muscle car” including the 2020 Mustang Mach-E, an electric SUV crossover (pictured here). In other words, Ford used the Mustang brand to first attract the untapped youth market and later to recreate that experience for an older generation. I then anticipated an additional objection. Any new tax, regardless of its initial purpose, would be more federal revenue and would only lead to more spending, not debt reduction. So, I suggested any new tax must be dedicated to that specific purpose. Right on cue, he asked, “Wasn’t that supposed to be the case with Social Security. Yet Congress raids it constantly to cover the deficit?” Yes, that is why this new tax should be created by amending the constitution as was the case with the income tax. The 16th Amendment put restrictions on the imposition of a federal income tax.

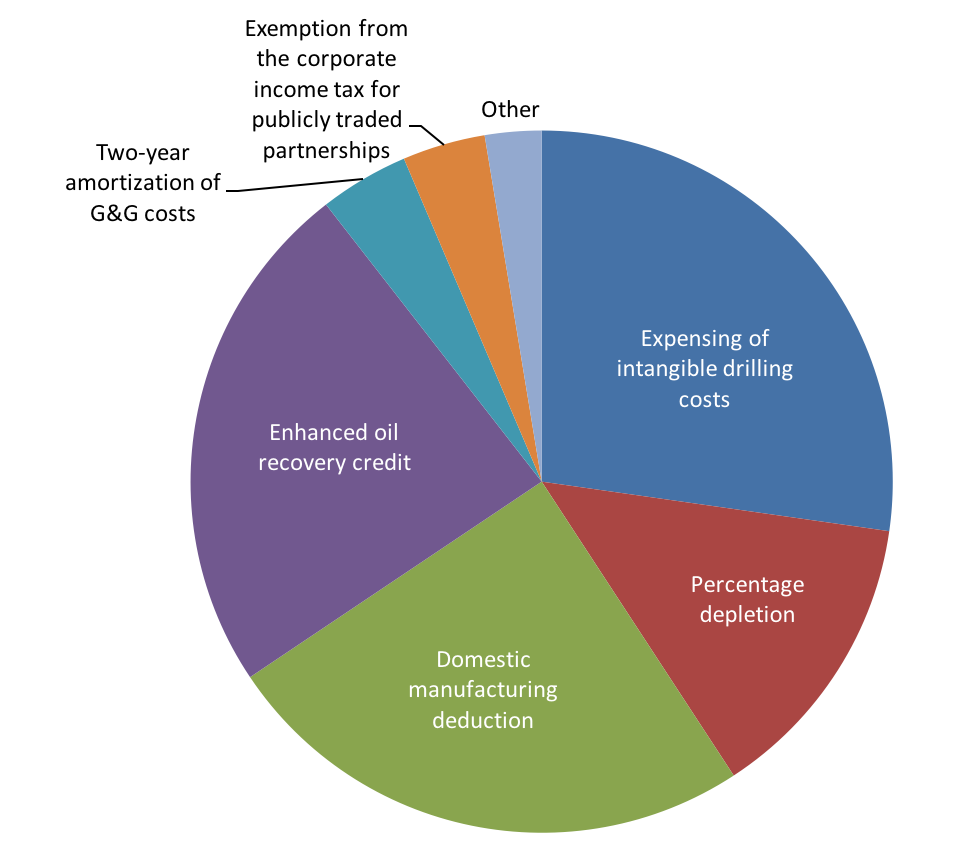

I then anticipated an additional objection. Any new tax, regardless of its initial purpose, would be more federal revenue and would only lead to more spending, not debt reduction. So, I suggested any new tax must be dedicated to that specific purpose. Right on cue, he asked, “Wasn’t that supposed to be the case with Social Security. Yet Congress raids it constantly to cover the deficit?” Yes, that is why this new tax should be created by amending the constitution as was the case with the income tax. The 16th Amendment put restrictions on the imposition of a federal income tax. In contrast, the FY2020 federal budget included $16 billion for Temporary Assistance for Needy Families (TANF). $66 billion for Supplemental Nutritional Assistance Program (SNAP) and $60 billion for HUD Housing Assistance. Compare that to the estimated $649 billion in direct and indirect U.S. subsidies to the fossil fuel industry in 2015. (Source: International Monetary Fund).

In contrast, the FY2020 federal budget included $16 billion for Temporary Assistance for Needy Families (TANF). $66 billion for Supplemental Nutritional Assistance Program (SNAP) and $60 billion for HUD Housing Assistance. Compare that to the estimated $649 billion in direct and indirect U.S. subsidies to the fossil fuel industry in 2015. (Source: International Monetary Fund). The above quote was made in reference to understanding the impact of charitable investments (i.e. grants, research and programs) by the Kauffman Center for Entrepreneurial Leadership for which Slaughter served as its first president. I was reminded of this warning as I watched the on-going congressional deadlock over the size of COVID-19 stimulus checks. My first epiphany was I had often paid attention to only half of what my colleague and friend was trying to tell us. Being a trained empirical social scientist, my focus had been on data collection and analytical methodology. But that was just one side of the equation. Too often I assumed I already knew what was important. But in this case I was not so sure. In other words, one needs not only to establish the method by which something is measured, but the why. Why would anyone want to expend time and effort measuring something in the first place?

The above quote was made in reference to understanding the impact of charitable investments (i.e. grants, research and programs) by the Kauffman Center for Entrepreneurial Leadership for which Slaughter served as its first president. I was reminded of this warning as I watched the on-going congressional deadlock over the size of COVID-19 stimulus checks. My first epiphany was I had often paid attention to only half of what my colleague and friend was trying to tell us. Being a trained empirical social scientist, my focus had been on data collection and analytical methodology. But that was just one side of the equation. Too often I assumed I already knew what was important. But in this case I was not so sure. In other words, one needs not only to establish the method by which something is measured, but the why. Why would anyone want to expend time and effort measuring something in the first place? Among the issues holding up passage of a second federal COVID-19 relief package is whether additional financial assistance to individuals should come in the form of extended unemployment benefits to approximately 13.5 million displaced workers or a second round of stimulus checks similar to the $1,200 per adult and child in round one. On Tuesday, Treasury Secretary Steven Mnuchin laid out the administration’s preference.

Among the issues holding up passage of a second federal COVID-19 relief package is whether additional financial assistance to individuals should come in the form of extended unemployment benefits to approximately 13.5 million displaced workers or a second round of stimulus checks similar to the $1,200 per adult and child in round one. On Tuesday, Treasury Secretary Steven Mnuchin laid out the administration’s preference.